01 February 2022 – The JP Morgan Asset and Wealth Management Annual Energy Paper is one of the most influential publications among global investment and business leaders in the energy sector.

But JP Morgan Chase’s 2021 Annual Energy Paper is a deeply flawed piece of work that promotes some serious misinformation about the clean energy transformation, reinforcing the mistaken belief – often promulgated by fossil fuel companies – that it will be slow, expensive and require onerous state intervention.

Coming from JP Morgan Chase – the world’s fifth largest bank, and the largest lender to fossil fuel industries – the paper informs the policy, investment and business decisions of many influential companies, organisations and governments around the world. Which is why it is important to understand that the world’s largest fossil fuel lender appears largely oblivious to the dynamics of technology disruptions and energy transitions.

Myth 1: Renewable energy forecasts are too optimistic

The Annual Energy Paper, authored by chairman of JP Morgan Asset Management’s chairman of market and investment strategy Michael Cembalest, was overseen by its technical advisor, influential academic Vaclav Smil.

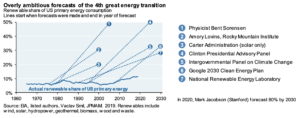

Its tone is set by a graph on the first page depicting alleged failed ‘renewable energy forecasts’. The graph seems to show that these forecasts were overly optimistic, and then repeatedly turned out to be false.

Yet according to Ketan Joshi, who previously worked in science communications for Australia’s national science agency, the sources for the alleged forecasts are impossible to trace.

For instance, he writes: “Danish physicist Bent Sørensen, for instance, seems to have published the figure between 1978 and 1980, and it isn’t easy to figure out where the prediction of 50% by 2000 was made. There was never any ‘Clinton Presidential Advisory Panel’ – the phrase can only be found in republications of this very chart; so that’s a mystery.”

In short, some of the alleged forecasts simply didn’t exist and therefore amount to little more than fabrications.

The other ‘forecasts’ were not forecasts at all, but policy scenarios that some experts advocated ‘should’ happen. Here’s another example noted by Joshi: “And, finally, a single sentence at the end states that ‘In 2020, Mark Jacobson forecasted 80% by 2030’. No, he did not. ‘It is not a graph of what will necessarily happen. It is a graph of what we need to happen to avoid 1.5C warming and to eliminate as much pollution ASAP’, Jacobson said on Twitter, describing his recent modelling studies.”

Many of the scenarios can’t even be classified as ‘overly ambitious’ yet, because they are still in the future. Scenarios 4, 5, 6, 7 and Mark Jacobson might turn out to happen.

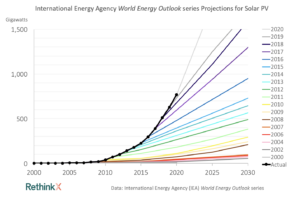

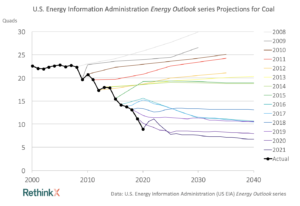

So the JP Morgan paper opens with a piece of flagrant misinformation that conceals an important reality: conventional forecasts of renewable energy have consistently failed not because they’ve been too optimistic, but too pessimistic: completely the opposite of JP Morgan’s claim.

Consider the year-on-year forecasting failures of two of the top energy watchdogs in the world – the International Energy Agency (IEA) and the US Energy Information Administration – both of which are repeatedly cited as authoritative by JP Morgan:

Under normal scientific standards, such consistent forecasting failures would render these agencies, their models and assumptions laughing stocks. Indeed, the incumbency’s track record of failed forecasts regarding renewable energy growth is very well-documented. The omission of this track record from the JP Morgan analysis is the hallmark of a biased document that is self-selecting and misrepresenting evidence.

Myth 2: Energy transitions are always slow

The JP Morgan paper’s general thesis is that energy transitions are always slow, and extremely expensive: “How is the global energy transition going? Taken together, the aggregate impact of nuclear, hydroelectric and solar/wind generation reduced global reliance on fossil fuels from ~95% of primary energy in 1975 to ~85% in 2020. In other words, energy transitions take a long time and lots of money.”

This assumption about energy transitions traces back directly to the report’s main advisor, Vaclav Smil, who was previously a fellow from 2008 to 2015 at the American Enterprise Institute (a well-known neoconservative think-tank with close ties to oil and gas firms, where much of Smil’s writing there, such as about fracking, reflected conventional mistakes).

The JP Morgan analysis traces back to three core arguments put forward by Smil throughout his work:

- Energy transitions must always be slow;

- Renewables will therefore not scale fast enough;

- Renewables will ultimately never be able to replace fossil fuels due to their lower energy density.

However, all these claims are deeply questionable, and rely on unstated and unjustifiable assumptions.

For instance, while it is true that the biggest energy transitions in human history have been slow, Smil offers no meaningful system dynamics-based explanations of why this was the case.

In fact, there are fairly obvious explanations. Prior to the interconnectedness of the era of globalisation, the global diffusion of technology was obviously much slower than what is possible today, and so a transition period of up to a century or longer for a major energy transition would not be unexpected. Fossil fuels are unequally geographically concentrated, and prior to the age of globalisation, it took time for supplies to be distributed around the world as the infrastructure to do so was built-up.

Another major issue is that the world of the nineteenth century (and prior) lacked both the financial capital and human expertise to deploy and scale energy infrastructure.

Today where large amounts of capital are available and solar, wind and battery technologies require far less capital than fossil fuels, and unlike the latter, they can be built anywhere at scale. This explains why many recent energy transitions at national levels have been far faster, taking place on decadal time-scales.

It also shows why solar PV and wind will not follow the same pattern as much older energy transitions. They are not limited by the same geographical production, refinement and distribution constraints of fossil fuels, and have entirely different deployment dynamics facilitated by an already existing global transportation and manufacturing infrastructure.

However, Smil mistakenly applies the past to the present without acknowledging that the last 200 years has seen the possibility space for rapid global change fundamentally transformed in a way that bears no antecedent in human history.

Drawing on Smil, the JP Morgan paper in effect repeats this basic category error which completely overlooks the fundamental difference between past and present. For most of human history, the world was not interconnected. We now live in a context where technologies can diffuse rapidly around the world, which has important new implications for energy disruptions.

In his compelling analysis of cases of rapid energy transitions, Nikos Tsafos of the Center for Strategic and International Studies’ Energy Security and Climate Change Program concludes:

“Many countries that have managed to grow without consuming more energy have reduced their consumption of specific energy sources and have changed their energy mix in a decade or two.”

As my colleague RethinkX research fellow Dr Bradd Libby points out, the bulk of the entire US military nuclear arsenal was built over a ten-year period from 1955 to 1965. In France, the nuclear industry provided less than 10% of national electricity demand in 1975, but this jumped to around 70% in just one decade by 1985. And there has been a dramatic drop in coal use in the US and UK in the last decade, replaced by a switch to natural gas.

And Smil himself acknowledges evidence that at a country-level analysis, rapid energy transitions do happen (and all in the last century), but fails to offer a framework to understand why and how some transitions are fast, while others are slow. Smil writes in his 2010 book Energy Transitions:

“… the record displays a remarkable scope of developments, ranging from the centuries-old dominance of English coal to an almost instant demise of Dutch coal mining, from a highly idiosyncratic and swiftly changing evolution of Japan’s energy use to the US orderly sequence of fuels during the first half of the twentieth century followed by a surprising post-1960 near-stasis of the primary energy make-up.”

In short, Smil’s transition analysis conflates renewables and fossil fuels as if they are like-for-like, ignoring the dynamics of technology disruptions. But renewables and fossil fuels are completely different, in the same way that coal was not like whale oil, cars were not like horses and smartphones are not like landlines. Ultimately, Smil’s work doesn’t provide any sound reasons for why solar, wind and batteries will not follow the rapid trajectory of other technology disruptions.

Myth 3: Fossil fuels’ domination of primary energy means they are here to stay

The JP Morgan paper argues that as wind and solar only account for 5% of primary energy, this proves that the transition is so slow that we can expect fossil fuels to enjoy dominance for decades: “In other words, direct use of fossil fuels is still the primary mover in the modern world, as the demise of fossil fuels continues to be prematurely declared by energy futurists”.

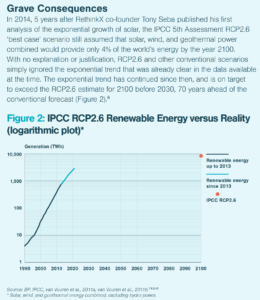

But in reality, this very figure suggests the transition is actually happening faster than previous projections. Consider what the IPCC 5th Assessment was predicting in 2014 – citing sources such as the IEA. In its best-case scenario (RCP2.6), the IPCC projected that solar, wind and geothermal would grow to provide 4% of global primary energy as late as 2100.

Consider, in contrast, the graph below from RethinkX’s report, Rethinking Climate Change: How Humanity Can Choose to Reduce Emissions 90% by 2035 through the Disruption of Energy, Transportation, and Food with Existing Technologies, which plots the growth of renewable energy on a logarithmic scale (the straight line up therefore indicating exponential growth).

The red dot at the top right represents the IPCC’s IEA-based projection. The dark line shows what’s happened up to 2013 with renewables. The blue line is the RethinkX forecast, which goes up to the present day, and if projected forward at that rate suggests renewables will hit 4% of global primary energy before 2029. So if it is already at 5%, that means the transition is already happening faster than anticipated.

As my colleague RethinkX research fellow Dr Adam Dorr commented on the stark implications: solar and wind growing are growing exponentially 78 years ahead of schedule on an 86-year forecasting horizon.

Myth 4: The renewable energy disruption, specifically, is slow and expensive

The JP Morgan paper cites the IEA’s projection that “70%-75% of global primary energy consumption may be met via fossil fuels in the year 2040.” Yet this ignores the economic implications of solar, wind and battery cost curve declines.

The data suggests not only that global solar and wind expansion are following Wrights Law of exponential growth, but that they are only just at the beginning of this ‘S curve’ of disruption.

Several independent experts, looking at the empirical data, have projected a rapid global transformation of the energy system within the next two decades. One recent reputable forecast, bizarrely ignored by the JP Morgan paper, was published by Oxford University’s Institute for New Economic Thinking in late 2021.

It found that early pricing prediction models have consistently underestimated both how far the costs of renewable energy sources might fall, and therefore how rapidly they can scale due to economic factors.

While the Oxford team see a rapid transition to 100% solar accelerating out to 2070, their ‘fast transition’ scenario based on current growth rates (which are actually still conservative) sees fossil fuels completely displaced by renewables by 2040 – the same date which the IEA insists fossil fuels will still be supplying three quarters of primary energy.

Most important is the Oxford team’s costs analysis. They found that the fastest deployment scenario is also the cheapest, creating savings of $26 trillion.

These findings are consistent with RethinkX’s conclusions, and with those of several other research teams – although our projections are more bullish (there are some limitations with the Oxford model, not least because they examine the energy system as if it exists in a silo immune to systemic feedback effects from other converging disruptions in transport and food systems).

All the available data, ignored by the JP Morgan paper, is consistent with solar, wind, batteries and electric vehicles being in the initial stages of the S curve, which means that the disruption – driven by economic factors – will be unstoppable well within the next two decades.

Myth 5: Renewables won’t scale as too many sectors are ‘hard to electrify’

The paper also displays a lack of understanding of the distinction between fossil fuels and renewables when it comes to primary energy. One of the most persistent claims of skeptics of the energy transformation is that as renewables still only account for such a small (5%) quantity of primary energy, this vindicates the idea that the transition is moving very slowly.

The JP Morgan paper asks: “Why don’t rapid wind and solar price declines translate into faster decarbonization? As we will discuss, renewable energy is still mostly used to generate electricity, and electricity as a share of final energy consumption on a global basis is still just 18%.”

But this is misleading, because in reality the global economy does not run on primary energy – the energy embedded in natural resources before conversion by human activity – but on final energy: the energy delivered to consumers to power our cars, keep the lights on and heat our homes. The difference between primary and final energy is in what the fossil fuel sector itself requires, along with huge transformation and distribution losses, all related specifically to the fossil fuel system.

What the paper obfuscates is that in the process of getting from primary to final energy, a huge amount of energy is wasted due to transmission as well as heat losses. In converting primary energy to electricity, some 63% is lost to waste heat. Yet solar, wind and batteries do not generate the same sorts of losses because they supply electricity immediately straight to the final energy stage. This means that we don’t need to replace all of primary energy because solar, wind and batteries represent a completely different type of energy system altogether without the same type of energy waste.

As Seb Henbest, chief economist at BloombergNEF, explains:

“It can also help to explain why many of the world’s most eminent energy experts have underestimated the growth to date of renewable energy, and its future potential. If we consider that the electricity sector consumes about 38% of fossil fuel production; and that renewables make up 25% of electricity, and wind and solar PV make up 25% of that, it easy to see how these technologies can get lost in the noise of a much larger primary energy analysis.”

This also means that the easiest way to replace fossil fuel dominance of primary energy is to electrify key sub-sectors such as residential heating and industrial processes, so that they can be powered directly from the new clean energy system.

The JP Morgan paper, in contrast, spends a lot of energy using fossil fuel’s dominance of primary energy to explore how industrial processes like steel and cement remain carbon-intensive and heavily fossil fuel dependent. It describes chemicals, pulp, paper, food, glass, brick and cement as “hard to electrify”, and claims:

“The challenge: low/medium electrification potential sectors use 2.5x the energy as high potential sectors. Even if we assume that all sectors are eventually electrified using new technologies, there’s still a large increase in cost. In addition to upfront switching costs, industrial companies would face costs per unit of energy that are 3x-6x higher for electricity than for direct natural gas. Electric heating efficiency gains vs combustion could offset part of this cost, but not all of it.”

But these unsubstantiated figures are related only to the framework of ‘switching’ within the incumbent system dominated by fossil fuels, rather than understanding the ground-breaking systemic implications of an optimally-designed 100% solar, wind and battery system which, recent figures suggest, would potentially produce more net energy than the incumbent fossil fuel system.

Such a system would enable what RethinkX has called ‘super power’ – producing 3-5 times more energy than is generated today, at a fifth of the cost.

Far from being ‘hard to electrify’, this massive surplus electricity generated at near-zero marginal cost will allow us to cheaply electrify transportation, heating, industry, mining, and other forms of energy use to a degree completely impossible within the incumbent system.

Myth 6: Fossil fuels are a better investment than renewables

“We recommend that investors stick with oil & gas for now,” the JP Morgan paper says, citing the IEA Stated Policies scenario to justify the conclusion that “the world is not on track to strand a lot of oil and gas in the future.”

To justify this stance, the paper criticises forecasts from Rocky Mountain Institute and Carbon Tracker referring to the imminent peak of global fossil fuel demand, saying that these are premature. However, it misrepresents even these forecasts.

In reality, Rocky Mountain cited Carbon Tracker which was referring to the DNV Energy Transition Outlook. The latter had concluded that “oil use may never again exceed 2019 levels”. The JP Morgan criticism offers little detailed assessment of this claim, nor does it acknowledge the broader evidence that peak fossil fuel demand is now unavoidable give or take a few years. Instead it sets up a narrative strawman to then ‘refute’ the idea that fossil fuels are facing an inevitable and imminent economic demise.

But even the IEA admits in its ‘net zero policies’ scenario that peak fossil fuel demand is imminent, and will occur by 2025 at the latest. And many other incumbent agencies converge with the DNV analysis – such as McKinsey (which sees peak oil demand at 2019), Boston Consulting, Rystad Energy, and even BP’s 2020 annual energy report.

Whether or not it might be premature to see peak fossil fuel demand happening as early as 2019, what one hopes to receive from a paper by JP Morgan is a balanced analysis of genuine use to investors. Instead we have a dogmatic approach hellbent on trying to show that fossil fuels are here to stay for the foreseeable future.

The evidence suggests, instead, that what comes next is very much dependent on societal choices. Bad decisions can indeed prolong the life of fossil fuel industries to some degree, but cannot ultimately stave off the economics of disruption. Such decisions are not due to market factors reflecting rational economic processes.

Instead, the economic analysis consistently suggests that one way or another fossil fuels have entered a downwards spiral of economic decline. Disruptions happen because of economic forces. As the new technologies are so much cheaper, the displacement of incumbent industries happens fast due precisely to the catastrophic financial consequences of failing to do so.

Renewable energy systems are vastly more economically competitive than conventional power plants in a fair market. Data shows that renewable energy systems are already cheaper than fossil fuel systems in most regions, and there is evidence I’ve assessed elsewhere indicating that their net energy returns are also already higher and will likely continue improving over time even while EROI for fossil fuels continues to decline. Together, these metrics provide a clear indication of where the economics is pointing: that renewables and technologies linked to them are outcompeting fossil fuels, and will increasingly disrupt them at an accelerating rate as this reality eventually becomes inescapable.

The incumbency faces disruption not just from one technology, but multiple. As costs continue to plummet and performance continues to improve in the energy and transport disruptions – both now happening exponentially – they are heading toward finally becoming up to ten times cheaper over the next two decades, a cost differential which is consistently associated with mass adoption, and the swift obsolesce of incumbent industries. The biggest danger to investors is complacency about what’s coming.

Myth 7: EVs are overvalued and internal combustion engines will be in business for many decades

That brings me to JP Morgan’s claim that EVs are vastly overvalued, and that investors are therefore going to lose their shirts. There may well be some valid grounds to believe some EV companies are overvalued – stock markets do operate in a way that routinely permits unsustainable bubbles. However, the JP Morgan paper appears to use this to imply that the EV disruption of conventional auto industries is not going to happen, and that they are on an equal footing with the disruptors.

The intellectually dishonest nature of this analysis can be seen when we factor in the deeper reality, once again completely ignored by the JP Morgan paper, that if we are going to be genuinely concerned about the overvaluation of assets or companies, it’s not EV companies where the action is. Rather, it’s fossil fuel investments that for decadeshave been vastly overvalued – in fact, strictly speaking, they already constitute stranded assets.

As RethinkX co-founder Tony Seba observed last year, “the fossil fuel industries and their value chains are already technically bankrupt”. Without $6 trillion a year subsidies, “these industries would collapse under their own economic dead-weight.”

Indeed, when using accurate data for the levelized cost of electricity (LCOE), solar, wind and batteries are already cheaper than conventional energy in most regions of the world, which is getting more expensive with time.

In other words, LCOE figures are actually far, far higher for conventional power plants than recognised by incumbent agencies like the IEA and EIA. The implication is stunning. It means that trillions of dollars of investments in these assets, premised on valuations linked to LCOE, cannot generate projected profits based on these figures. This means that conventional power generation assets, and assets across the entire value chain (from mines to wells to refineries to pipelines to ports to ships) are already vastly overvalued and will never meet hoped for returns. In other words, there is now a large and rapidly expanding financial bubble around conventional coal, gas, nuclear, and hydropower energy assets. The real scale of this overvalued trillion dollar bubble, built up over decades, is therefore massive.

Yet, for some reason, JP Morgan’s paper appears to suggest that it’s more important to argue that EV companies are overvalued in the market, and that investors will lose money investing in EVs – rather than in fossil fuel assets whose real economic value is already “technically bankrupt.”

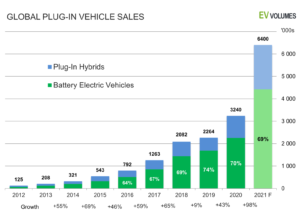

Overall, JP Morgan’s suggestion that EVs are rising far too slowly to generate a disruption to conventional auto industries is seriously mistaken. All the data shows that EV cost curves are declining exponentially, and that adoption is at the beginning of the S curve. Mass deployment is happening faster than RethinkX previously forecast, not slower.

Arguably, the analysis fails to appreciate the economic factors behind why a company like Tesla might receive such high valuations. If the RethinkX, Oxford and other projections are remotely accurate, renewables, EVs and other disruptive technologies are opening up exponential economic opportunities and introducing tens of trillions of dollar savings. Clean energy systems will also introduce vast new business models. Companies at the forefront of these disruptions will therefore be in prime position. That the market might reflect these underlying economic dynamics is therefore not surprising – rather than indicating an EV bubble that will collapse, it indicates an EV growth trajectory that will permanently and inevitably disrupt companies invested in internal combustion engines.

Even conventional analyses bear this out. Last July, for instance, Ernst & Young found that combined electric vehicle sales in the US, China and Europe will outstrip all other engine sales by 2033, and that by 2045, non-EV sales will shrink to less than 1% of overall sales. Needless to say, although this study came out a month after Arnott’s paper, JP Morgan ignores it.

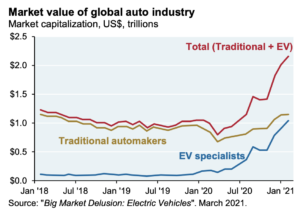

In this context, it’s extremely difficult to take seriously the below graph in the JP Morgan report.

The graph is presented as if it implies that EVs and conventional auto industries are on an equal footing. Without even quibbling the presentation of the underlying data, it’s clear that these figures – limited to January 2021 – are already outdated, irrelevant and of little use to projecting where things are heading in 2022.

And those trends are not exactly invisible. From 2020 to 2021, EV sales doubled despite the pandemic as part of a continued exponential growth rate.

Colin Mckerracher, head of BloombergNEF’s transport analysis, argues that EV sales will near double again in 2022, comprising around one in seven of all vehicle sales. He concludes: “This is usually the tipping point for market adoption into the exponential growth phase of the S-curve.” Another analysis projecting forward this growth rate concluded that “most new vehicles” will have a plug in by 2027.

No wonder in January 2021, Morgan Stanley was seeing an entirely different reality, as reported here by Yahoo! Finance:

“New research from Morgan Stanley argues that traditional internal combustion engines – the mainstay of automobiles for more than a century – are destined to become money-losers as early as 2030. ‘We believe the market may be ascribing zero (or even negative?) value for ICE-derived revenues at GM and Ford,’ auto analyst Adam Jonas wrote in a Jan. 29 analysis. He lists a variety of factors likely to ‘transform what were once profit-generating assets into potentially loss-making and cash-burning businesses.’”

While these dynamics will not manifest immediately – taking time to unfold as EV costs continue to decline and mass adoption continues to accelerate – the JP Morgan report essentially keeps trying to say, in effect: ‘it’s not happening right now, so it won’t happen for decades and conventional industries are here to stay’: a verdict that is just not borne out by the data.

The paper also fails to understand the implications of the EV disruption, casting the longer lifespan of cars as an inhibitor to vehicle replacement that is slowing down adoption. The longer age of light vehicles “has the unintended consequence of delaying penetration of new technologies like EVs”, claims the paper. If there were any validity to this claim, EV sales would not be increasingly exponentially. In reality, it demonstrates a genuine incomprehension of how disruptions work.

EVs will replace internal combustion engine vehicles because they are cheaper, better and longer-lasting. As the disruption accelerates, these metrics will improve so dramatically that owning an ICE vehicle will be increasingly costly, self-defeating and pointless. As costs-per-mile declines, the EV disruption will kickstart ‘Transport-as-a-Service’ (TaaS) because it will end up being cheaper to travel in EV vehicle fleets run by a private firm or public agency than to own a car.

And the paper completely ignores how TaaS, too, will be transformed due to exponentially improving autonomous driving technology. As EVs hit mass adoption, the network effect of real-time autonomous driving data will accelerate this improvement, making self-driving EVs a reality quicker than most conventional analysts expect. This will make TaaS even cheaper as the cost of labour is removed, which will further accelerate the transport disruption. In short, all the signs of massive, rapid transformation in our energy and transport systems are now unmistakeable.

We can, of course, fundamentally agree with one contention of the JP Morgan report – that not every EV company currently receiving high valuations will necessarily survive. In a highly competitive market, we can expect many different disruptors to come and go before we know which companies make it at the end of a decade or two of disruptions. But one thing that is clear from the pattern of disruption in history is that incumbents generally do not survive disruptions, because they are incapable of understanding the dynamics of the disruptive technologies that displace them – they are locked, instead, into the prevailing, old value chains, mindset and paradigm that are all about to be swept away.

The JP Morgan paper does not, in my view, offer its investor clients genuine insights into the prospects of the unfolding energy transformation. But it does offer a brilliantly insightful window into the Ostrich-like mentality of the incumbency: desperately trying to convince itself, and more importantly its investors, that change is not coming, and that it will be so expensive and difficult to transform our energy and transport systems, that business-as-usual is going to continue virtually indefinitely.

None of this means the path ahead will be easy. But the biggest obstacle to transformation does not come from inadequacies in solar, wind and batteries, or EVs. It comes from institutions like JP Morgan which, unwittingly or otherwise, appear to be in denial about the unstoppable clean energy disruption that is unfolding right now, and sadly as a result capable of promoting egregious misinformation in pursuit of that denial.

First published in Rethink Disruption